Frequently Asked Questions

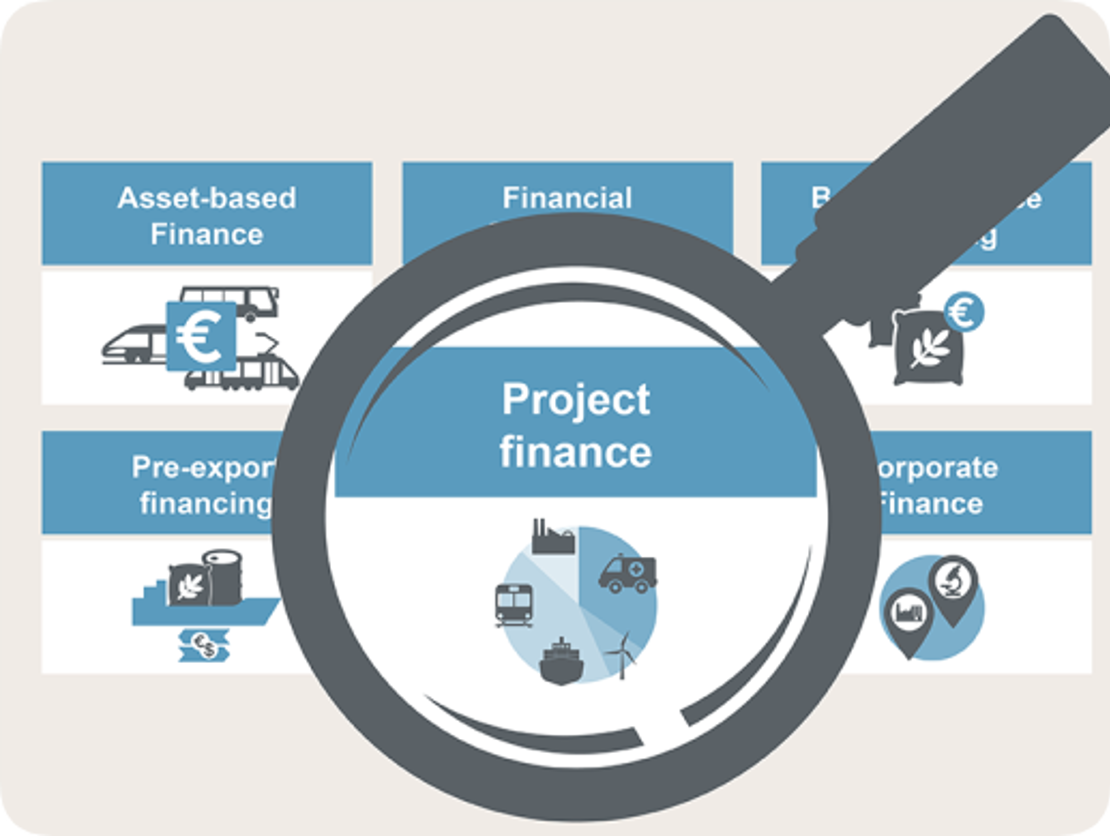

What is Project Finance?

After almost eight decades the unique Project Finance investment structure has evolved out of all recognition to its 1950’s incarnation. Then, it was led by the largest global financial institutions financing industrial and infrastructure reconstruction after the devastation of WWII. Now, project finance is a unique structure where investors lend against the track record and financial stability of whoever is contracted to buy the output from the built project. These considerations override the assets and balance sheet of the borrower. A properly structured project financing leaves the project principals be they private or public sector free and clear of any financial liability whatsoever.

Please note that PFX is now transitioning from it's old domain at projectfinanceexchange.com to it's new PFX.Exchange domain. PFX personnel will be progressively using the PFX.Exchange domain e-mails and referring to content on the PFX.Exchange website.

Consequently, the only source of finance with the flexibility to fill the $multi-trillion global project financing gap is that provided by the private markets including asset managers, hedge, alternative investment, private debt/equity funds, family offices and a range of other private capital funds. However, some institutional lenders are now responding to the A+-rated insurance Wrap which is now available through PFX. This elevates the transaction to equivalence with any mainstream fixed-income asset.

All opportunities listed on PFX have an off-take agreement with a credible entity, or a feasibility study clearly presenting how funds will be repaid. Off-takes include Power Purchase Agreements with national/regional grids and major corporations and Management and Operating Agreements with strong brands for hospitality, healthcare, infrastructure and projects across all other sectors.

Whether you are an investor or capital raiser, please take your time and have a good look around our site. We are consolidating the opaque and fragmented global private capital/project finance market, which has all the attributes of a global capital market in its own right. PFX is the long-overdue medium through which you can now seamlessly identify, connect and engage with your investment partner. Privacy prevails across PFX.

Project finance history goes back a long way. The first recorded project financing was in 1299 when an Italian merchant bank, the House of Frescobaldi, funded a silver mine in Devon, England, with the loan repaid with revenues from the output from the mine. In itself, the first manifestation of the unique ‘project finance’ structure.

In which countries can PFX investors operate?

Any country not sanctioned by the UN.

Can PFX Investors fund Public Private Partnership Projects?

Yes

What is your minimum and maximum deal value?

$100m with no upper limit across all sectors.

Are there any sectors you cannot invest in?

Yes, defence is the most obvious but any other sector that has defence or other political aspects to it.

As project principals we hear that we are '...left free and clear of any liabilities whatsoever.' How?

Your financing is provided and underwritten against the track record and financial stability of whoever is contracted to buy the output from your built project. The same criteria applying to your contractors, designers and all other counterparties involved in the project. All project financings are structured through SPV's (special purpose vehicle) which is an entirely separate entity to your own company or government, which leaves you free and clear of any financial liability, whilst still retaining majority ownership of your project.

Comprehensive insurance wraps provide protection for investors. However, project finance is, essentially, lending against revenues from a yet-to-be-built asset, from which mainstream banks are precluded by their own regulations. Be prepared for the granular due diligence required by the private markets investors, who are the primary source of project finance. Further information on the private markets in our Media Backgrounder.

So, what separates PFX from all the other ‘investment platforms’ we investors have to look at?

Project finance is a $multi-trillion market populated by thousands of investors on the buy-side and thousands of projects on the sell-side at any one time. The PFX 'mission' is to consolidate what has always been a hopelessly fragmented and opaque market with thousands of investors on the buy-side and thousands of projects on the sell-side at any one time. Further information in our Media Backgrounder.

In deal value terms many project financings are as large as IPO’s, which have to meet widely accepted prospectus requirements. PFX expects its project finance opportunities to do the same, saving everyone time and money. When you’re satisfied that PFX will make a positive impact on your deal origination, please go to the Investors zone so we can welcome you into the PFX investor community.

PFX operates through 20 regional intake centres each overseen by their Regional Manager providing the essential human interface. Professional advisors such as accountants, consultants and others can now also submit opportunities they may occasionally encounter through our Professional Advisors zone.

Why should I make my private business public on the exchange?

You don’t. Look at any Elevator Pitch in our pipeline, and you will see that there is no identifying information available to the public domain. Only PFX registered investors can view the Executive Summary to see that kind of detail, and only after they have been through our initial DD when they register.

Why is my investor refusing to provide proof that they have the funds available for my project?

Unless your investor is an institution who you already know, they are (far more) likely to be a hedge, private debt/equity or alternative investment fund, a family office, asset manager, mandated lender or one of the many other entities who manage and allocate capital for their private investor clients, collectively known as the 'private markets'. They aggregate funds from their investor clients to invest into individual projects through the SPV (Special Purpose Vehicle). Those investor clients will not want disclosure of their corporate or personal information. Would you?

What costs can we expect to incur prior to receiving funds?

All investors are different, but you can usually expect to incur some costs which can cover due diligence, underwriting preparation, surveys legal and other costs. But there are countless funding structures each with their own set-up costs for the investor and client respectively. Any costs you are expected to incur will be clearly presented in your conditional terms sheet or your investor’s equivalent document.

Please do not expect your investor to cover all the costs for you. They are handling dozens of projects at any one time and carrying all the legal, due diligence, accounting, survey and other costs involved for each project would create unsustainable risk.

If using the Insurance Wrap, there are set-up fees to cover the time spent by the A+-rated underwriters involved in preparing it. This time has to be covered in the event your transaction fails for whatever reason, which it won't if you have been completely transparent with all information requested.

How does PFX make money?

I am an investor. Am I connected directly to the project principals when I offer to engage?

Yes.

In which country is PFX registered?

UK.

Is PFX regulated?

No. The Private Capital market is, so far, unregulated. But most PFX registered funds are regulated dependent on their jurisdiction and because they actually manage funds for private individuals or institutions. PFX is a media/information management company.

What role does PFX play between all the stakeholders?

We have added a ‘media layer’ to the traditional intermediary business model, enabling us to share investment opportunities amongst a much wider audience of potential investors but with privacy assured and identifies protected. We are therefore a ‘closed marketplace’ of verified investors and completely ‘submission ready’ opportunities (only the investor can decide when a project is ‘shovel ready’). Privacy is assured at all levels with no investor or project identifying information available to the public domain.

Which sectors can PFX Investors fund the projects?

Agri; Airports; Aviation; Bio-Fuels; Bridges; Care Homes; Clinics/Hospitals; Commercial RE; Dams; Fisheries/Fish Farming; Healthcare; Hospitality; Hotels/Resorts; Hydro-Electricity; Infrastructure; In-Ground Assets; Leisure/Recreation; Media; Nuclear Energy; Oil & Gas; Ports; Potable Water; Power Distribution; Renewable Energy; Residential RE; Road/Rail; Satellites (Commercial); Senior Living; Shipping/Marine; Social Infrastructure; Social/Affordable Housing; Solar Farms; Spaceports; Technology, Media & Telecommunications (TMT); Trams; Transport/Distribution/Warehousing; Tunnels; Utility (gas, water, sewage etc); Waste Recycling: Waste-to-Energy; Waste-to-Fuel; Wave/Tidal Energy; Windfarms.

How do investors separate the deals they're interested in out of the hundreds available?

They are notified personally of opportunities that match the investment criteria they provided to our Investor Liaison team on registration. They register all investor preferences by deal value, country/region, market sector and other specific criteria. They are provided a link to the listing and, if they wish to move forward, they can then access the full Executive Summary and data-room.

Can PFX Investors fund Governments directly?

It is always the project that is funded, not the project principals so it doesn’t matter if the borrower is a local or regional government, corporate body or any other entity.

Will PFX Investors consider government projects who are looking for an EPC contractor?

No. Any project listed on PFX must have all contractors in place with agreements completed or at an advanced stage of development.

Can PFX Investors provide Islamic financing?

Some.

Can PFX Investors provide financing as debt or equity or combination of both?

The preferred structure is long term debt, but some funds will take an equity stake.

In debt financing is collateral needed? If yes what are the different collaterals accepted?

In project financing, the collateral is the viability of the project itself as assessed by the investor and their underwriters. This is predicated on the financial stability and track record of the contracted off-taker and other counterparties involved in the project.

What costs can we expect to incur before being financed?

All those costs that go with preparing your project for financing which includes architects, land acquisition/leasing/optioning, permits, permissions, access and other essentials before the project can be considered for financing. Also, most investors now want an insurance ‘wrap’ which incurs a set-up cost of between £10,000 and £30,000, with premiums added to the loan. How much depends on the nature of the project and eventual cost of the Wrap. PFX investors do not get involved in costs incurred in preparing the project for financing.

At what stage is the due diligence done, before or after signing the unconditional/conditional term sheet?

After signing the conditional terms sheet.

Who does the due diligence?

Most investors have their own licensed providers who will conduct the major part of all due diligence. Any further specialist verifications are usually contracted out to specialists in the market concerned whose job will be to verify information you have provided as an ‘approved’ party.

However, some investors are now insisting on PFX carrying out its due diligence and compliance preparation work (although final liability is accepted by the investors) for which PFX necessarily has to charge the project principals. This 'PFX Processing', where required, is refunded on completion of the transaction.

Is a feasibility study mandatory as part of the documentation?

Feasibility studies are essential where there is no off-take or power purchase agreement. In some of these cases feasibility studies are provided in addition. Feasibility studies are usually required on transit, infrastructure and other projects where anticipated usage/uptake needs to be clearly defined. The study must come from a credible body that is acceptable to the investor and their underwriters.

How long will it take for the investor to fund the project?

Much depends on the complexity of the project. A general guideline is to allow four to eight months (or more depending on project complexity) from funder engagement to receipt of funding.

Can the financing be done in the currency of the country of project?

No. The hedging cost would increase underwriting and other costs on the loan terms. PFX Investors fund in EUR, GBP and USD.